First of all I would like to thank you for finding time from your busy schedule to read this page. We give you 100 % guarantee that you will get something new from this page. It will add value to your life and to others.

I am grateful to God , to the Universe and to LIC of India for because of them I am able to add new service in my website SuSayan.in

You all know policy bazaar sells insurance from all insurance companies in India to their own customers through their website policybazaar.com .

Similarly I have also decided to sell Life Insurance from LIC of India to my own customers through my website SuSayan.in .

Life Insurance is very very important for everybody to protect their family , to protect their income , to protect their retirement .

Insurance works on the principle of ‘Mutuality’ i.e sharing the Risk ( financial loss ) of Few by Many through Risk Pooling . LIC follows ‘Yogakshema’ ( a word from Gita sloka ) means “Your Liability is my Responsibility” . Means LIC will take the responsibility of your family in your absence or will take the responsibility of your own life in your accidental disability. Is there anybody on this earth who can guarantee you that he/she will take responsibility of your family in those events. But LIC can guarantee you. Although I don’t want you to die or to become disable but if you know that in this event LIC will give you or your family good amount of money then you can live and do your work without any worry or tension.

For these above reasons I have decided to encourage every Indian to invest good percentage of their income into LIC of India. Our promise is to share the right information of every LIC policy to every customers. Discussing with us about Investment Plans and Business Opportunity is free but buying LIC policy is your choice. We have decided to guide our customers honestly. At the same time We don’t force any customer.

Even NRI and FNIO ( Foreign National Indian Origin with OCI ) can also invest their money into LIC . There are many profitable reasons for which NRI and FNIO should invest their money into LIC to protect their wealth and to double or triple their money. NRI and FNIO can buy LIC policy even when they are living outside India through Mail Order Business by contacting us.

You can buy LIC policy through us and you can refer your friends, relatives and colleagues through our Referral System . If you refer anybody then whenever they will buy any product or service from our website you will be greatly rewarded.

You can buy LIC policy through us even if you are from different states or currently you are living in different states or you are living in different country. After purchasing We will help you to get your policy transferred to the branch which you will prefer most.

Tax Benefit : Income tax will not be deducted on the amount invested in LIC under section 80C . Income tax will not be deducted on the return you will get from LIC at the the time of maturity under section 10 (10D) . NRI and FNIO don’t need to pay GST on the premium. Why govt. has given tax exemption on Life Insurance ? Its because Life Insurance is so important for everybody that govt. wants to encourage everyone to buy LIC policy to protect their family.

We offer Best Online Solutions related to Pension Plans, Child Education Plans, Tax Saving & Investment Plans, NRI Plans and many more from LIC of India.

If you buy LIC policy through us we guarantee to provide below services : ( we can provide services for your existing policies also ) .

- Maturity Claim processing

- Nominee Change or Addition

- Duplicate Policy Bond

- Loan against policy

- Address Change in your Policy

- Date of Birth Correction in your Policy

- Revival of Lapsed Policy

- Change of Mode of Policy Premium payment

- Surrender of Policy

- Linking Bank account against Policy

- Linking PAN Card, Mobile number & Email id against Policy

- Death Claim Processing

- Service Branch change nearest to your residence

- Creation of Online Account in LIC Official website for easy management of policies.

- Many more customized solutions as per your requirement.

Please feel free to contact us for any services you need.

Do you want to know why NRI or FNIO with OCI should buy LIC policy ? Then you have to contact the person who has referred you then get his/her referral code then register in this site using that referral code then login then click/touch on NRI Business Opportunity .

Jeevan Labh without AD & DB : Invest 4908 Rs. per month for 10 years and get approx. 11.32 lakh after 16 years . In case of death your family will get 7 lakh to 11 lakh .

Jeevan Labh with AD & DB : Invest 4915 Rs. per month for 10 years and get approx. 11.15 lakh after 16 years . In case of normal death your family will get 7 lakh to 11 lakh , in case of accidental death family will get 13.66 to 17.85 lakh . In case of accidental disability you will get 13.66 to 17.85 lakh .

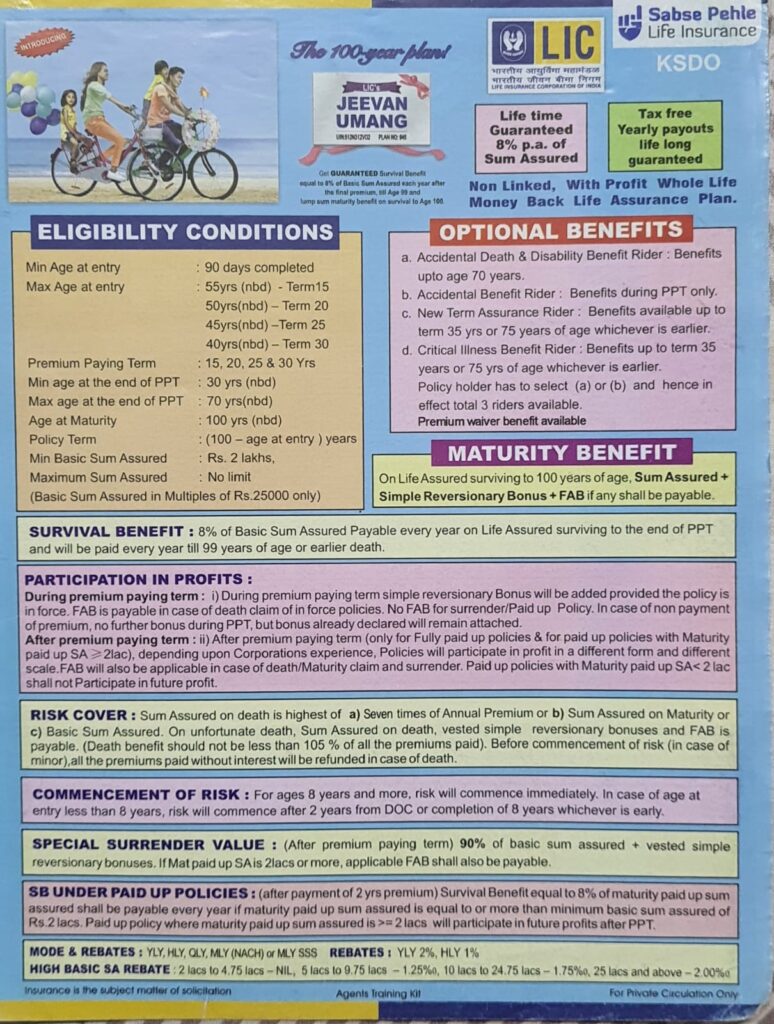

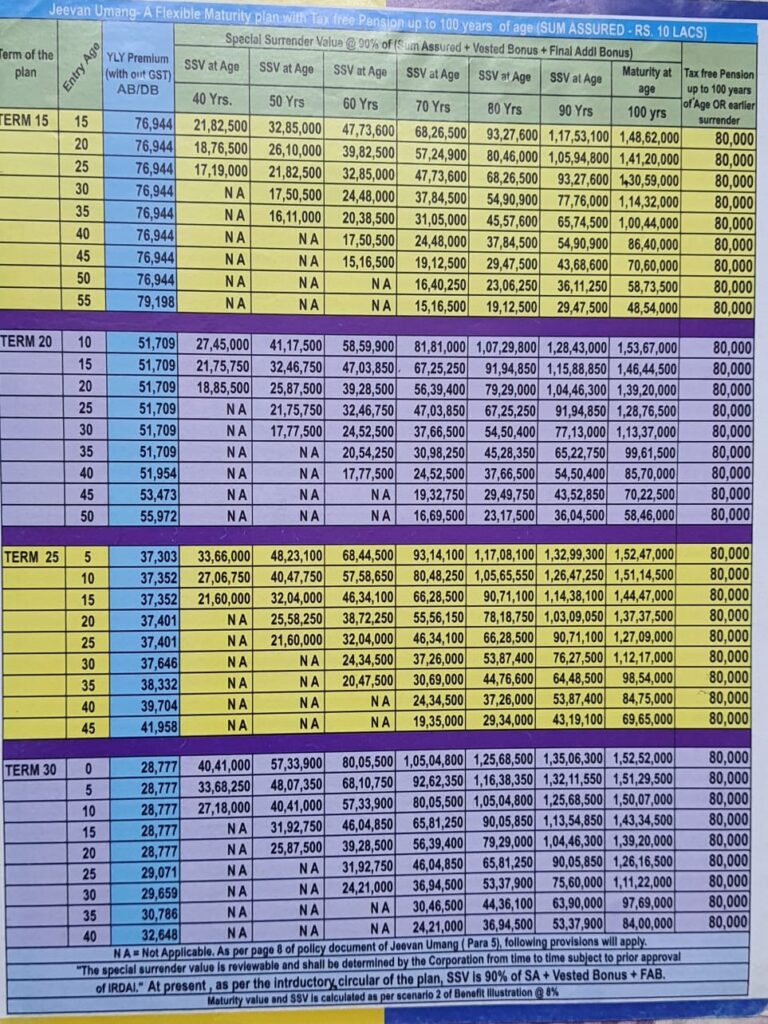

Jeevan Umang is a whole life insurance. It can be treated as pension plan or child education plan . If you pay 2 lakh every year for 15 years then after 15 years you will get 2 lakh as pension every year whole life. After 15 years you can withdraw the money anytime. If you withdraw after 35 years you will get approx. 1 crore .

Term Insurance : Pay only 13 Rs. per day and get benefit of upto 50 lakh .

Benefits : No survival benefit. In case of normal death your family will get 25 lakh , in case of accidental death family will get 50 lakh , in case of accidental disability you will get 50 lakh.

Systematic Investment and Insurance Plan ( SIIP ) : If you are a risk taker person and wants to invest in share market then only you should go for it because it’s Unit Linked Policy and it’s similar to SIP . Like SIP here also 4000 Rs. or more will be deducted from your account and LIC Fund manager will invest in share market based on their experience and you will get units for that amount. But in SIIP insurance is extra benefit and tax or any other charges will not be deducted on the return . After 5 years you can encash ( full or partial ) your units anytime or you can keep for greater return. On death higher of guaranteed S.A. or unit value is payable.

Yearly 4 times you can switch among different fund categories like equity fund ( major amount invested in share market ) , debt fund ( major amount invested in bonds , fixed interest bearing securities ) , balanced fund and money market fund.

Documents needed :

1 ) PAN card ( Self signed xerox )

2 ) Aadhar card ( Self signed xerox )

3 ) Company Identity Card both side xerox or Salary slip or income proof ( Self signed xerox ) 4 ) nominee id proof

5 ) cheque

6 ) application form with 4 signature

7 ) photo